Waterfall Modeling

Waterfall Modeling

Instantly generate auditable waterfall calculations

Instantly generate auditable waterfall calculations

AI automated waterfall models

AI automated waterfall models

AI automated waterfall models

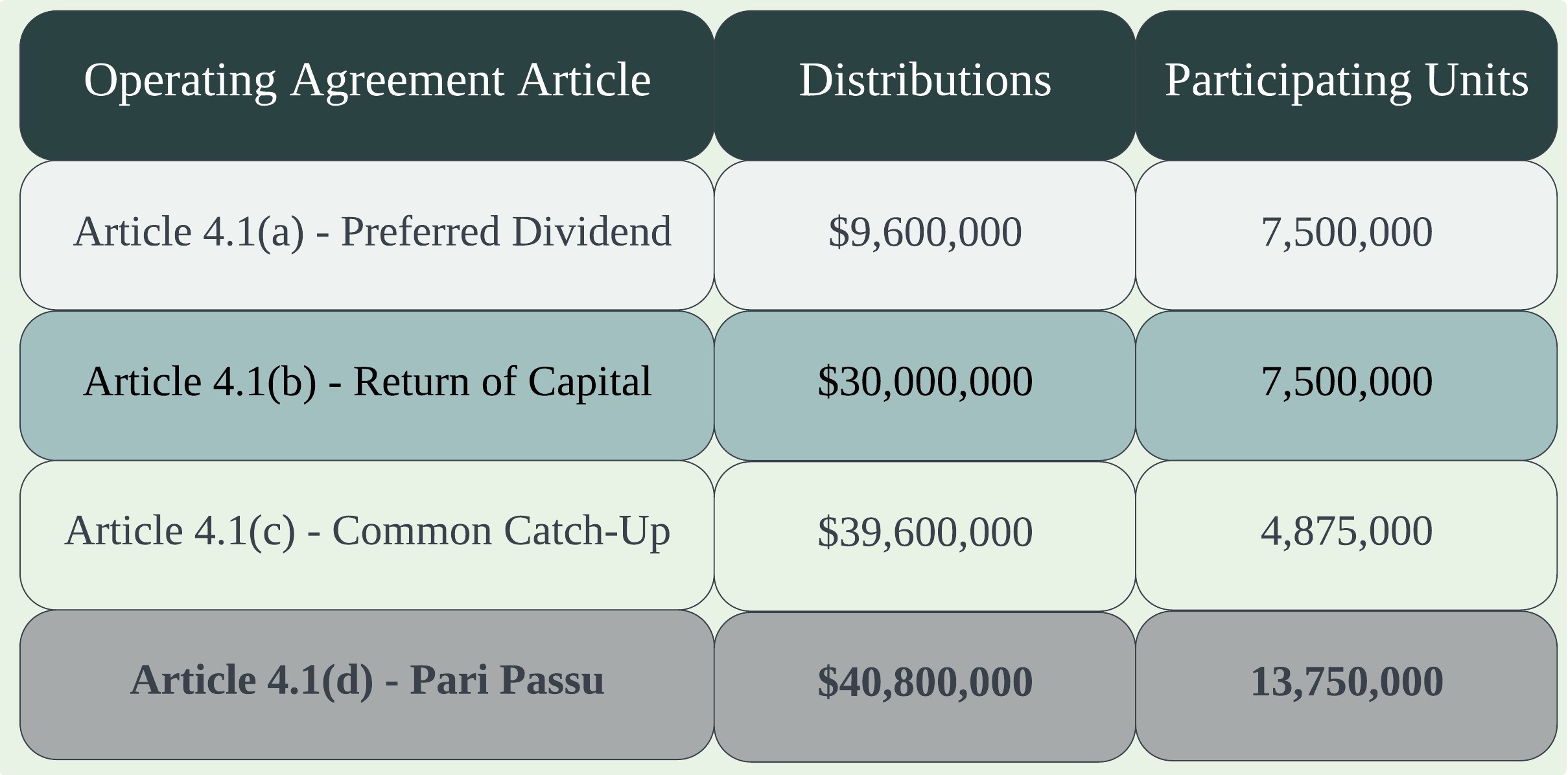

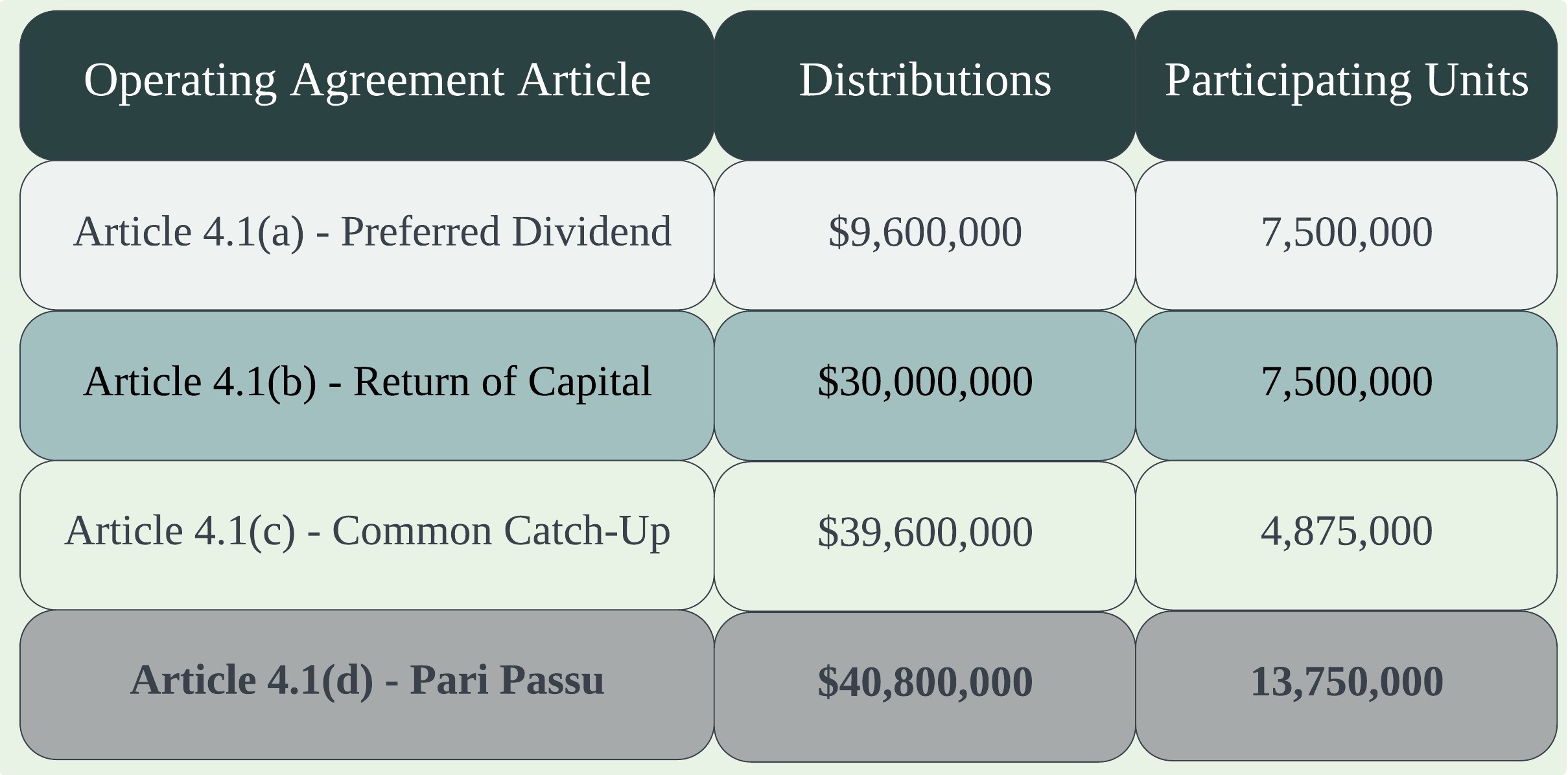

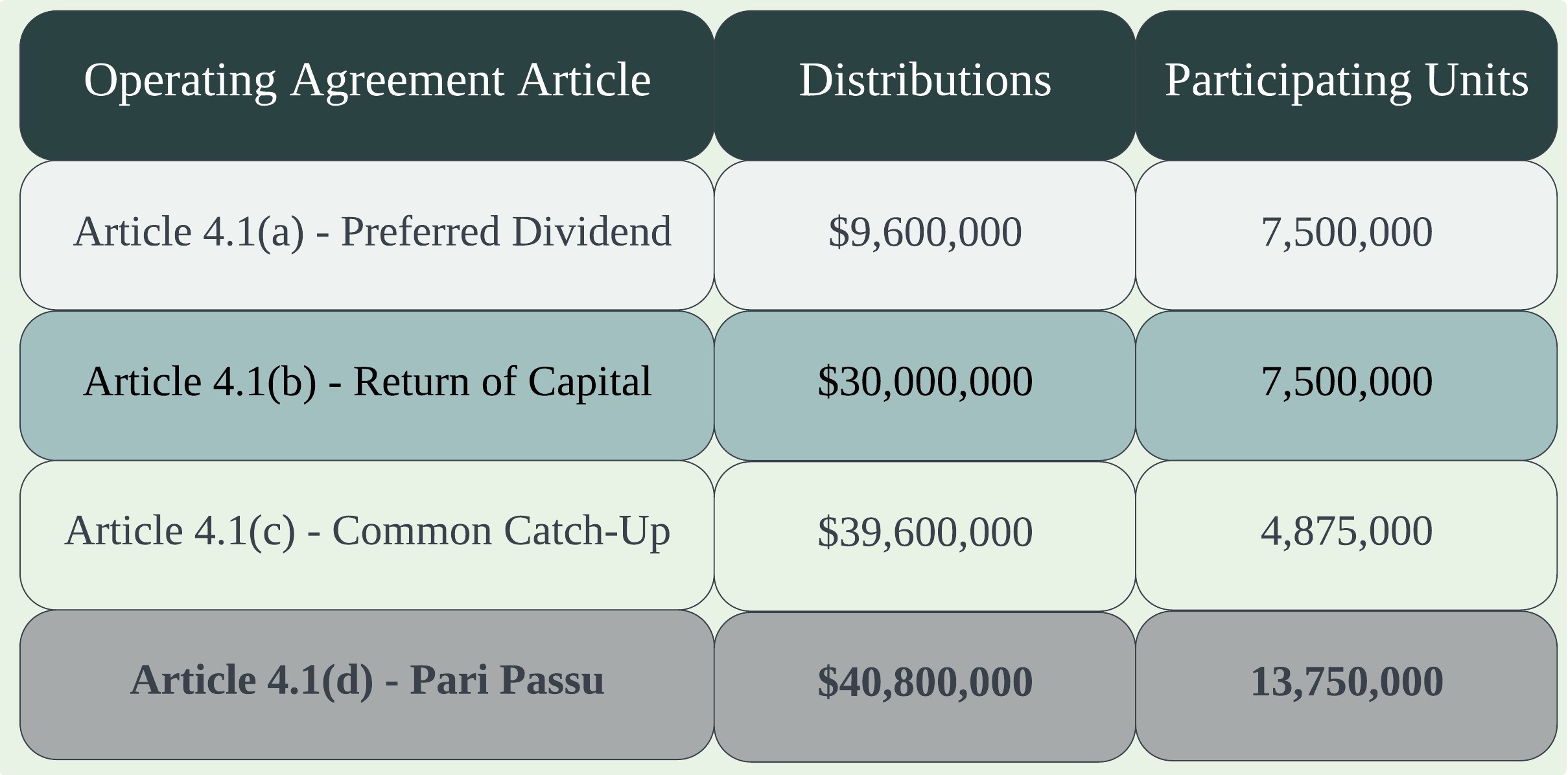

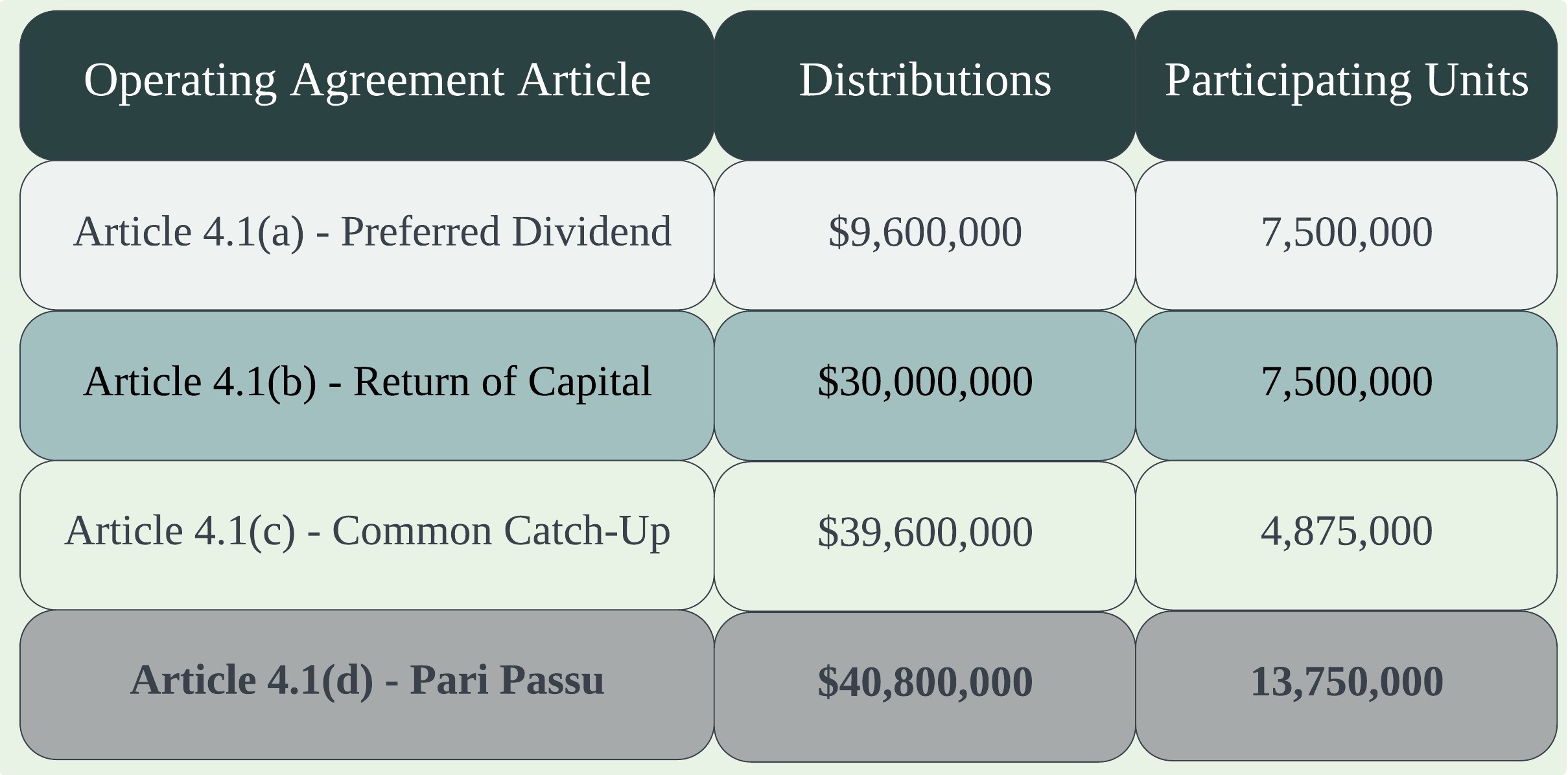

With Meji's AI-powered platform, private equity funds can automate waterfall modeling across their entire portfolio.

Each portfolio company’s waterfall calculations sync directly with its cap table, which Meji's LLM updates instantly as new equity agreements are executed.

With Meji's AI-powered platform, private equity funds can automate waterfall modeling across their entire portfolio.

Each portfolio company’s waterfall calculations sync directly with its cap table, which Meji's LLM updates instantly as new equity agreements are executed.

With Meji's AI-powered platform, private equity funds can automate waterfall modeling across their entire portfolio.

Each portfolio company’s waterfall calculations sync directly with its cap table, which Meji's LLM updates instantly as new equity agreements are executed.

Complexity, solved

Complexity, solved

Meji's waterfall modeling handles any level of complexity, from profits interests and options across tiered strikes to convertible securities, preferred dividends, and bespoke performance vesting rules.

By eliminating tedious, manual spreadsheets across the entire portfolio, funds can de-risk their models while simultaneously empowering their deal teams to focus on their most impactful work.

Meji's waterfall modeling handles any level of complexity, from profits interests and options across tiered strikes to convertible securities, preferred dividends, and bespoke performance vesting rules.

By eliminating tedious, manual spreadsheets across the entire portfolio, funds can de-risk their models while simultaneously empowering their deal teams to focus on their most impactful work.

Complexity, solved

Meji's waterfall modeling handles any level of complexity, from profits interests and options across tiered strikes to convertible securities, preferred dividends, and bespoke performance vesting rules.

By eliminating tedious, manual spreadsheets across the entire portfolio, funds can de-risk their models while simultaneously empowering their deal teams to focus on their most impactful work.

Browse Our Services

Swipe to Browse Our Services

Swipe to Browse

Our Services

Contact us to get started

Contact us to get started

Contact us to get started

© Meji Capital Analytics LLC. 2024

© Meji Capital Analytics LLC. 2024

© Meji Capital Analytics LLC. 2024